The essence of the betting strategy called “Kelly Criterion” is to determine the size of each next bet for more reasonable management of your game bank (bankroll). It is believed that this method allows you to protect the entire bankroll from losing, since it does not provide for a fixed bet size: the player independently evaluates the probability of the event on which he plans to bet, and, based on this, calculates the optimal bet size using a special formula.

When to use the Kelly Criterion in betting?

The Kelly criterion is more suitable for those who already have some experience of playing in bookmakers, since the success of this strategy is determined, first of all, by the player’s ability to independently determine the probability of an event.

In fact, the strategy can be considered a kind of competition between the player and the bookmaker, since the winner is the one who more correctly determined the probability of the event.

The Kelly criterion is considered to be an improved copy of Value Betting, and it is worth using it in cases where the bookmaker underestimated the probability of an event and, accordingly, set an overestimated odds for it. In the environment of bookmaker clients, such an event is called value – “value”.

The disadvantages of the Kelly criterion include the possibility of an incorrect self-assessment of the event by the player. So, if the player overestimated this probability, he will remain a loser. If he underestimated it, this will lead to a smaller win.

How to play according to the Kelly criterion: calculation formula and examples

The Kelly criterion formula allows you to calculate the optimal bet size for a particular event. We repeat: this size will be optimal if the bookmaker underestimated the probability of the event, and the player estimated it correctly.

Let’s say Barcelona meets Sevilla, and the odds for the victory of the blue garnets is 1.40. To understand what percentage of the probability of Barca’s victory the bookmaker considers correct, we calculate according to the above formula: 100% ÷ 1.40 = 71.4%. That is, the bookmaker believes that Barcelona will win with a probability of 71%.

The player who wants to make a bet believes that the probability of success of Barca is 60%. Thus, the proposed quote is not overpriced (not value), because the probability of the outcome, according to the player, is lower than the odds offered by the bookmaker. Such a bet for the game according to the Kelly criterion is not worth taking.

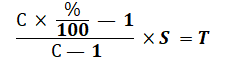

In order to correctly calculate the optimal bet size according to the Kelly criterion, we use the following formula:

C – odds offered by the bookmaker

% – the percentage of the probability of an event according to the player

S – bankroll size

T – required bet size

This betting strategy is more suitable for experienced players, since it is always difficult to independently determine the probability of an event without the help of a line of odds.